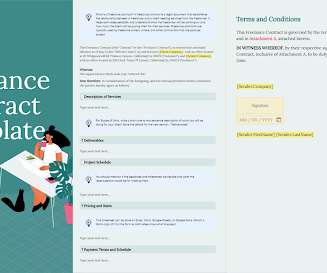

5 Essential Legal Documents For Freelancers

Freelance Writing Jobs

NOVEMBER 29, 2022

The idea of freelancing is a wonderful concept. With the largest freelancing market in the world, a staggering 67.6 million people freelance in the US. . In fact, an MBO study found that 82% of freelancers found that they are happier working independently. 5 Essential Legal Documents For Freelancers.

Let's personalize your content